Worried about nursing home costs?

Despite what you've been told, it's not too late to protect your loved one's assets from the nursing home. Get started by answering a few questions about your situation—it only takes three minutes.

At Senior Care Counsel, we help seniors and their families find financial relief from the nursing home. We provide the resources needed to navigate your situation with care and confidence, match you with a dedicated planning professional, and help you avoid the "Medicaid spend-down."

If your loved one is in a nursing home, we help protect their savings.

How It Works

We connect those dealing with a long-term event with a professional who specializes in protecting assets and providing financial relief.

Answer

Take three minutes to answer a few questions about your loved one's situation.

Connect

You get matched with a qualified long-term care planning professional.

Plan

You receive a personalized asset protection plan designed for your loved one.

Resources

Take advantage of our free resources to learn about the long-term care planning process, how you can protect assets from Medicaid, and more. When you're ready to stop losing money to the nursing home, we're here to help.

Having The Long-Term Care Conversation

Check out tips for starting this crucial discussion with your loved one.

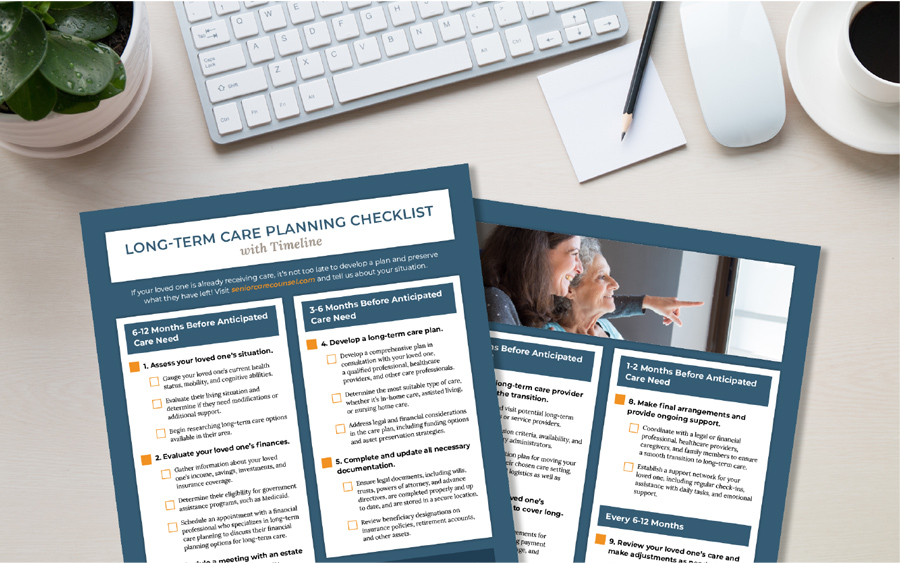

Long-Term Care Planning Checklist

Here's a timeline to follow if your loved one will need care in the next year.

Common Medicaid Myths: Debunked

Allow us to dispel some common myths surrounding the Medicaid program.

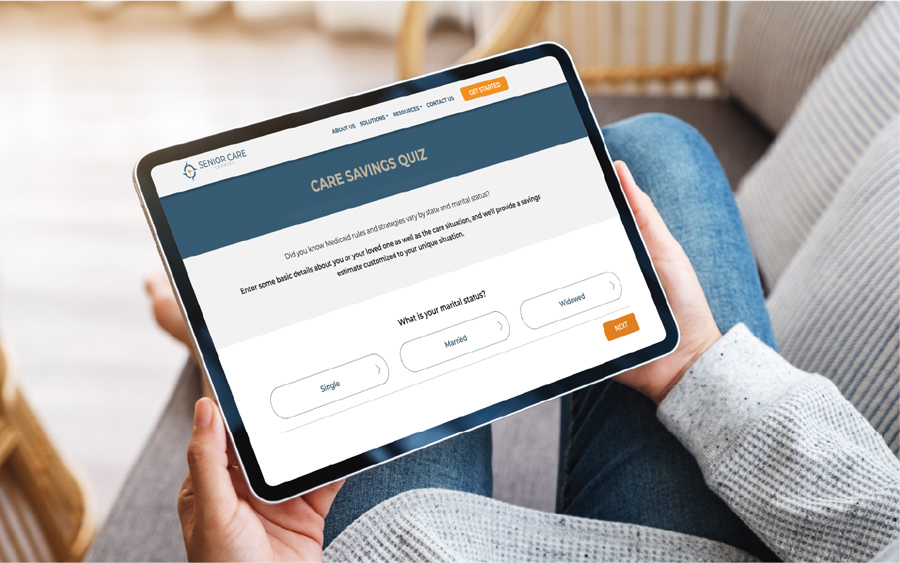

Take the Savings Quiz

Discover how much you or your loved one could save with a proper long-term care plan.

Why Work with a Professional?

Learn why you should work with a qualified professional in the planning process.

Who We Are

Our mission is to educate families on the options available to them. Despite what the nursing home says, it's never too late to protect your assets.

Trending Topics

Explore topics related to long-term care planning, spend-down options, the Medicaid program, and more.